Hey, it’s Jeffrey — back again!

Here's a question nobody asks about their credit cards: What's my actual return on this thing?

Not "am I breaking even on the annual fee?" That's the wrong bar. Breaking even means you got your money back, but nothing more. You still fronted $795, managed credits across different portals, and spent mental energy tracking what you've used. That's not free. That's work.

I wanted to know which of my cards are actually earning, so I gave Claude my real usage, not the best-case scenario from the benefits page, but what I actually use, how often, and whether I'd genuinely miss it if it disappeared.

The gap between my best and worst cards was bigger than I expected.

I want to calculate the true ROI of my credit cards — not whether I recoup the annual fee, but whether I'm actually coming out ahead based on what I personally use.

For each card below, I'll describe my actual usage. Please:

Assign a realistic dollar value to each benefit based on my actual usage — not the maximum possible value

Discount or zero out any benefit that requires extra spending I wouldn't otherwise make, or that I only use because it's "free"

Calculate net ROI: total value captured minus annual fee

Flag any benefits I'm leaving on the table completely

Give me an honest verdict: keep, downgrade, or cut

[CARD NAME] — $[ANNUAL FEE]/year

[Benefit name]: [How often or how much you actually use it]

[Benefit name]: [How often or how much you actually use it]

Monthly spend on this card: $[X] on [categories]

Repeat for each card.

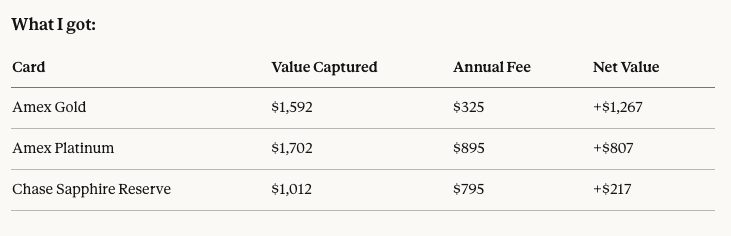

What I got:

The Gold surprised me most as it's quietly my best-performing card by a mile. $1,400 a month in groceries and dining at 4x points does serious work against a $325 fee. That's nearly $4 back for every $1 in fees.

The Reserve is the one I'm watching. Strip out the $300 travel credit, and the card needs to generate $495 in value on its own. It's doing that (barely), but most of my dining has migrated to the Gold anyway. That's exactly the kind of slow drift that makes an expensive card obsolete without you noticing.

The other thing Claude flagged that I hadn't considered: my Lululemon quarterly credit on the Platinum gets counted as a benefit worth $300/year. But we’re spending $300 to get $300 back in credits. That's not a benefit, that's a manufactured spending trap. So, it’s zeroed out for the ROI math to give me a better idea of the true numbers.

Keep going? Once you've got your results, try asking:

"Based on my results above, which single change to my spending habits would improve my overall ROI the most?"

"I'm leaving [X benefit] on the table every month. What's the easiest way to actually use it without it becoming a hassle?"

"If I were to cut one of these cards, which would it be — and what would I lose that I can't replicate elsewhere?"

When it all clicks.

Why does business news feel like it’s written for people who already get it?

Morning Brew changes that.

It’s a free newsletter that breaks down what’s going on in business, finance, and tech — clearly, quickly, and with enough personality to keep things interesting. The result? You don’t just skim headlines. You actually understand what’s going on.

Try it yourself and join over 4 million professionals reading daily.

How did you like today's newsletter?

One quick note: This newsletter is for educational purposes only and does not constitute financial advice. I'm not a financial advisor — just someone sharing ideas and tools I've found useful. Use what works for you, skip what doesn't, and always do your own research. Some links may be affiliate links or sponsored content for which I may receive compensation.