Hey, it’s Jeffrey — back again!

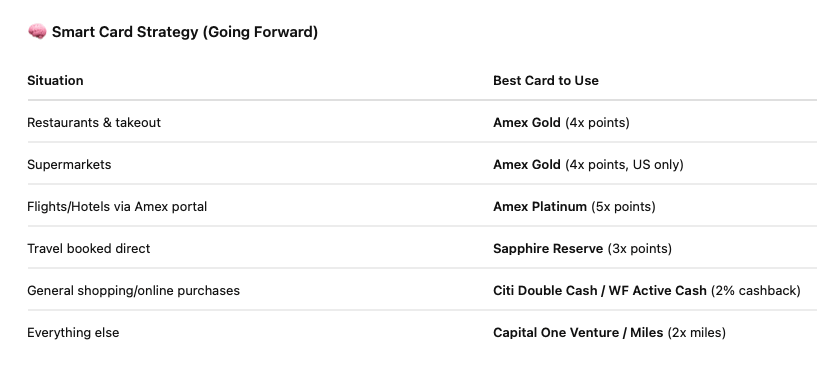

I have 7 credit cards in my wallet. Each one earns different rewards on different things — groceries, dining, travel, gas, you name it.

Here's the problem: I can never remember which card to use where. So I default to whatever's convenient. My go-to card. The one on top of my wallet.

And it turns out? That's been costing me. A lot.

I ran a simple analysis with ChatGPT, feeding it three months of spending and my current cards. It took 10 minutes.

What it found shocked me: I've been leaving nearly $2,000 per year in rewards on the table — just by using the wrong card at checkout.

Not because I'm careless. Just because it's impossible to keep track of which card earns what where.

Sound familiar?

🧠 The Idea

You export your recent spending — from Monarch, your credit card, or your bank.

Then you ask ChatGPT to go merchant by merchant and tell you:

Which credit card would've earned the most rewards

What category the merchant falls into (dining, travel, groceries, etc.)

What card you should use next time for that merchant

It's like having Max Rewards in your inbox — but free.

Go from AI overwhelmed to AI savvy professional

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

💸 The Stakes

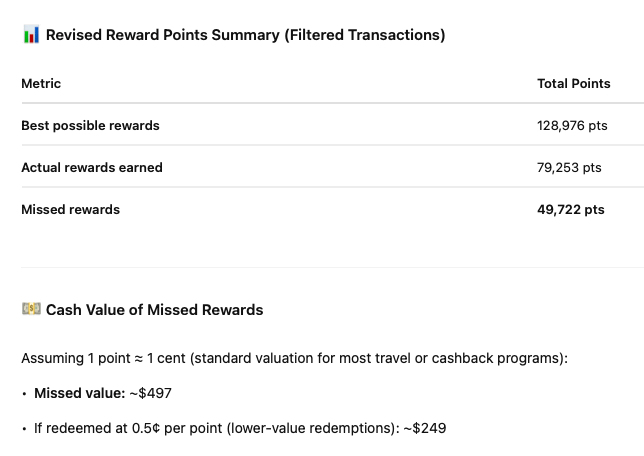

I thought I was doing pretty well with credit card rewards. Turns out, I wasn't even close.

By consistently using the wrong card for everyday purchases — groceries, gas, dining, travel — I was missing out on thousands of dollars in potential rewards every single year.

The math is brutal: $497 per quarter of mis-optimized spending adds up to nearly $2,000 annually.

And I'm not alone. Most people with multiple cards face the same problem: it's just too hard to remember which card earns what where.

🧪 My Real Example

I exported 3 months of spending from my Monarch Money account into a CSV (very easy to do with a few clicks). You can do this with each credit card too.

Then I gave ChatGPT this:

Here's a list of transactions from the last 3 months. Can you analyze which cards I have that would've earned the most rewards per merchant, and suggest the best one to use next time?

[upload your CSV]ChatGPT went through every single transaction and matched it to my best card. Here's what it found:

I had to ask: how much had I lost out on by suboptimal spending?

This is pretty shocking stuff! And remember — this wasn't random spending. These are merchants I go to regularly, which means I'm making these expensive mistakes every single month.

Pro Tips

📊 Run this quarterly — your spending patterns change

🎯 Tweak your goals in ChatGPT - tell it whether you want to prioritize a certain rewards program, points program, or cash back.

🆕 Considering a new card? Ask ChatGPT: "Based on my spending, which card would give me the biggest rewards boost?"

⚠️ Don't chase rewards into debt — only use this if you pay in full monthly

💡 One Smart Read:

Committing to a certain credit card or loyalty program can help you earn benefits, but it can also become an anchor that stops people from getting more value than they could. Brand loyalty likely won't maximize your rewards — but brand disloyalty might. This is exactly why tools like ChatGPT are so powerful: they help you stay loyal to yourself, not to a card issuer.

🎯What to Do Now

✅ Export your last 3 months of spending (CSV from your bank/card or Monarch)

💬 Paste the prompt into ChatGPT with your card list

📊 Calculate how much you left on the table

💳 Set a calendar reminder to run this quarterly

📤 Know someone with a wallet full of cards they never optimize? Forward this

How did you like today's newsletter?

One quick note: This newsletter is for educational purposes only and does not constitute financial advice. I’m not a financial advisor — just someone sharing ideas and tools I’ve found useful. Use what works for you, skip what doesn’t, and always do your own research before making financial decisions and using the tools shared in this newsletter.